Why I left Wells Fargo

#

My wife and I recently closed our Wells Fargo accounts after months of considering it. We had set up our bank accounts in a way that made sense to us, and we were tired of trying to fit that into Wells Fargo’s scheme (and the fees that came with non-compliance).

What I want from a bank is fairly simple.

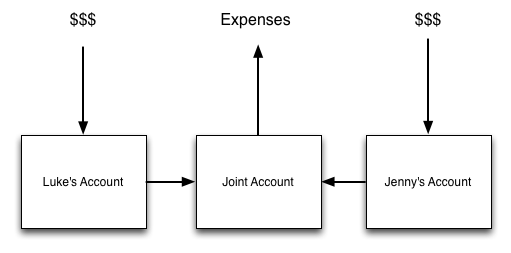

I would like to have an individual account for myself and my wife, and a joint account for our combined finances. Each of us has our own income and expenses, and we share the joint expenses of the household, which are paid out of the joint account, to which we each contribute to.

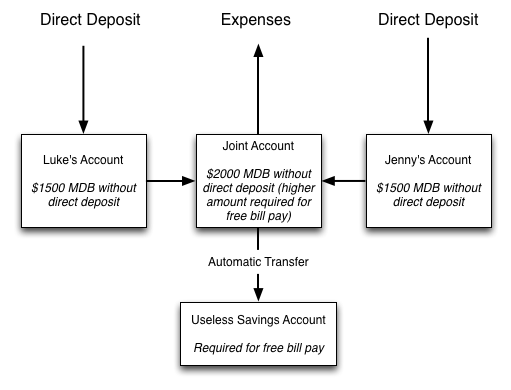

However, setting up something like this at Wells Fargo is very difficult, because Wells Fargo requires a direct deposit or minimum daily balances for each account.

Wells Fargo’s most basic checking account has a $1500 minimum daily balance. To get free online bill pay, you must maintain a $2000 minimum daily balance (along with an associated useless savings account – current intrest rate: 0.01%). My wife and I have variously had and not had direct deposit throughout the years. When I was consulting, I didn’t, and she did. Now, I am an employee and I have direct deposit, but she doesn’t. And, since we deposited the money into our personal accounts, the joint account never had a qualifying direct deposit.

Attempting to use this setup at Wells Fargo meant juggling money between the accounts to ensure a combined daily balance of between $3500 and $5000. Every time we failed to do so, Jenny or I would trudge down to Wells Fargo and banker would reverse the fee and explain how to configure a “package” to avoid future fees. But it always boiled down to: both of us should get a regular job (with direct deposit) or close one or more of our accounts.

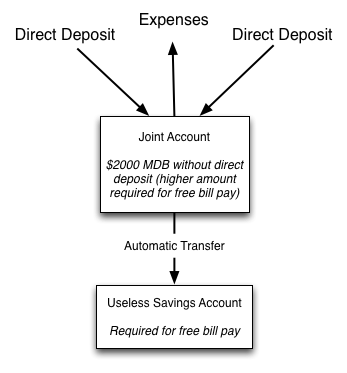

Apparently, Wells Fargo thinks working couples should manage their finances like this:

They call this a “package” with “benefits”, but I call it moulding my finances to fit their bureaucracy, and I’m done with it. We moved our banking to a credit union, which besides being free and having no minimum balance, allows us to create as many sub-accounts as we want.

Moving our money was a major pain that took over a month to complete, and I would have rather not done it. If Wells Fargo simply allowed a combined minimum balance, we would almost certainly still bank there.

I understand banks are charging account fees because the Federal Reserve took away their ability to screw over customers with overdraft fees. But we held quite a lot of money at Wells Fargo (my business account was also there – notably, it had no restrictions I ever noticed) and used our check card frequently. On balance, it seems better for Wells Fargo to have us as customers than not. After all, customer support costs are proportional to the number of customers, not the number of accounts.

Wells Fargo should let its customers manage their money the way that makes sense to them.